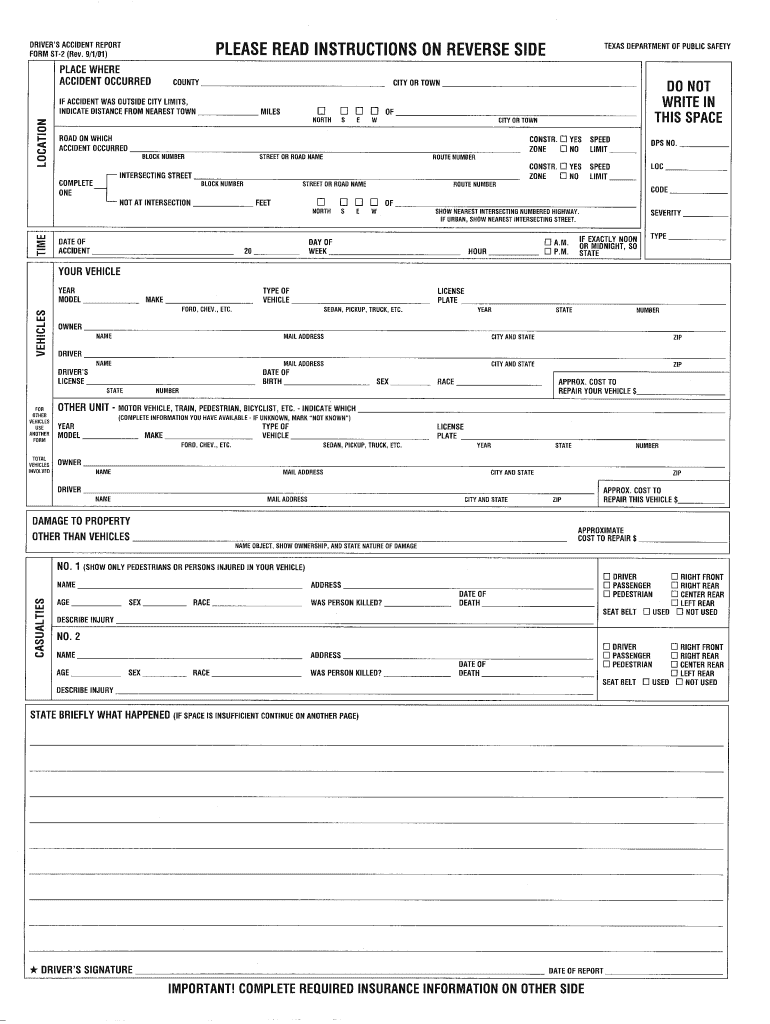

Who needs an ST-2 Form?

This form is completed by the driver of a motor vehicle (or owner) involved in a car accident. The report can be used only if this accident is not investigated by a law enforcement officer and lead to injury or death of any person or caused at least one thousand dollars in property’s damage.

What is the purpose of the ST-2 Form?

The Driver’s Accident Report contains the information about the accident, vehicles involved in an accident and casualties. The second part of the report provides the required insurance details. The report is used by the Accidents Records Bureau to get all the necessary information about what happened and how this accident can be avoided in the future.

What other documents must accompany the ST-2 Form?

This form consists of two parts: Driver’s Accident Report and Texas Motor Vehicle Accident Insurance Information. As a rule, these documents are accompanied by copies of driver’s license and registration receipts.

When is the ST-2 Form due?

The driver has to complete and sent the report within ten days after the accident.

What information should be provided in the ST-2 Form?

The Driver’s Accident Report has six sections for completion:

- Location: place where the accident happened (city or town, road, street, route number)

- Time: date and time of the accident

- Vehicles: model, type, license plate, owner and driver (their address, date of birth) of all the motor vehicles involved in an accident

- Damage to property other than vehicles: details and the approximate cost of repairs

- Casualties: pedestrians and other persons injured in the driver’s vehicle

- Detailed description of the accident

What do I do with the form after its completion?

The completed form is forwarded to the Accident Record Bureau, Texas Department of Public Safety, Austin TX.